Bitcoin 'Champion' Strategy: Hoarding Dollars Mid-Selloff - Crypto World Reacts

Saylor's "Green Dots": Bitcoin or Just Covering His Ass?

The Green Dot Cometh... With a Catch So, Michael Saylor, the Bitcoin messiah, teases "green dots" —implying *more* Bitcoin accumulation. What does it *actually* mean? Strategy is raising $1.44 billion, not to buy more magic internet money, but to create a "US dollar reserve" to cover dividend payments. [Source Title: Strategy announces $1.44 billion “US dollar reserve” to avoid participating in bitcoin fire sale] Oh, the irony. Let's be real, Strategy basically *is* Bitcoin maximalism incarnate. "Strategy exists to buy bitcoin," the company even admits. But who needs Bitcoin when you can have cold, hard cash to pay off those pesky preferred shareholders?The "Infinite Money Glitch" Crashes and Burns

The "Infinite Money Glitch" is Over Remember when Strategy's stock was soaring? Saylor was pumping out AI-generated posts and making quasi-religious claims about Bitcoin. Higher stock price meant more shares issued, which meant more Bitcoin bought, which meant higher stock price. It was an "infinite money glitch," as some called it. That spell is broken. Shares are down 70% from their peak. And now, instead of using that sweet, sweet equity to buy Bitcoin, they're hoarding dollars. The market ain't happy. Strategy's stock price dropped. Who could have seen that coming? I mean, diluting common shareholders to pay dividends to preferred shareholders? It's like robbing Peter to pay Paul, except Peter is you, the average investor getting reamed. And get this: Strategy's general counsel, who was suspiciously selling off his own shares as the stock tanked, is now "retiring". Coincidence? Maybe. But it sure smells fishy.Saylor's "Hodl Forever" Promise? Yeah, Right.

Bitcoin to the Rescue? Maybe Not Strategy is holding 650,000 Bitcoin, worth around $56 billion. That's 3.1% of the world's total supply. But here's the kicker: if their "mNAV" (Saylor's pet metric) falls below one, they'll sell Bitcoin to fund their dollar reserve. So much for "hodling forever." They're trying to spin this as "navigating short-term market volatility". But let's call it what it is: damage control. They're admitting that their business model is vulnerable, that their stock price might fall even further. Then again, maybe it's all part of the plan. Saylor is just playing 4D chess while we're all stuck in checkers... or maybe he's just really good at marketing BS. The Emperor Has No Clothes (Or Bitcoin) Strategy is now talking about "BTC Escape Velocity" and "BTC Cruise Speed". Give me a break. It's corporate jargon designed to distract from the fact that their core business is a house of cards built on Bitcoin hype. The company has made a big show this year of launching five classes of preferred stock but then had to sell them at a large discount to liquidation value that made the dividend commitments extremely costly to service. Saylor's turned Strategy into a reality TV show. Loud, lurid, and addictively compelling. But theatrics don't pay the bills, and it's the common shareholders who are left holding the bag. The big question is this: Is there any reason to own Strategy's common stock anymore? I'm not seeing it. This is One Giant Clusterf*ck

Related Articles

Internet Computer: What's Behind the Crypto Surge?

Internet Computer's 37% Jump: A Glimpse into the Future of Blockchain Stability? Alright, folks, buc...

DeFi Tokens 2025: Who's Getting Rich (Again)? - Thoughts?

Solana Meme Coins: Are You Kidding Me? Okay, lemme get this straight. We're still talking about...

Crypto Chaos: The Unseen Breakthrough Ahead (Reddit's Take)

Alright, buckle up, because we're about to dive into something seriously exciting—Solana. I know, I...

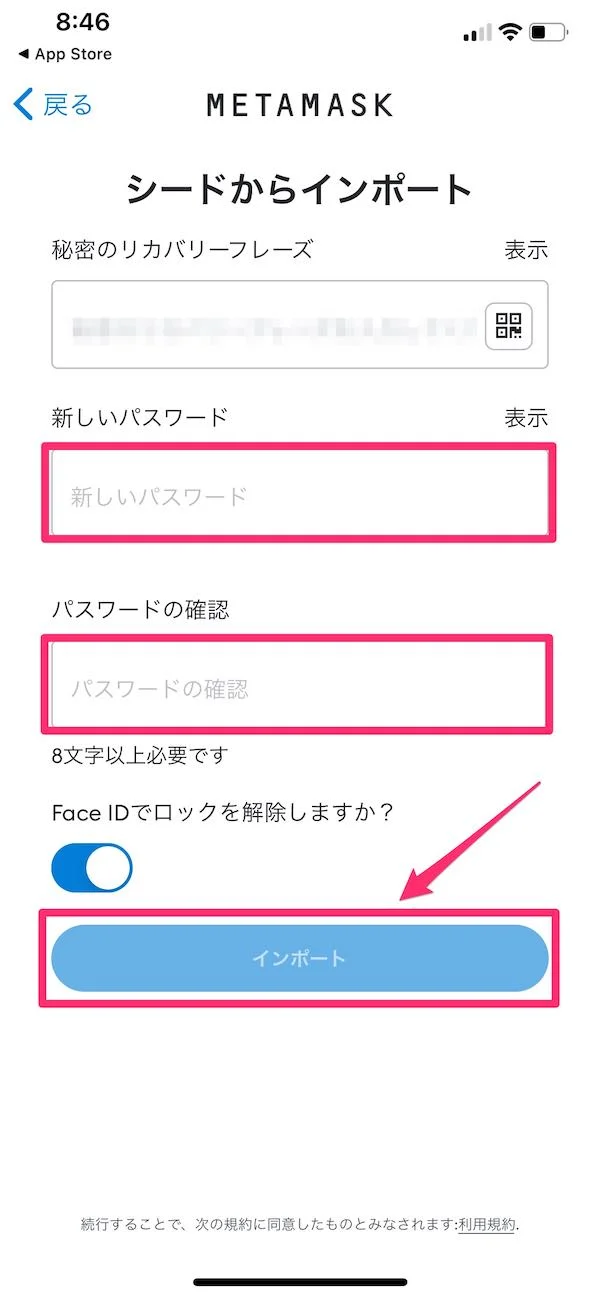

MetaMask: What It Is, How It Works, and Why It's Your Key to Web3

For years, we’ve thought of MetaMask as a key. A simple, indispensable tool. It’s the friendly fox i...

Pudgy Penguins: The Price Hype and What We Actually Know

So, everyone’s losing their minds over whether the Pudgy Penguins crypto token, PENGU, can "defend"...

Bitcoin Rally to $100,000 Predicted by BTIG: The Real Story Behind the $100K Hype

Bitcoin $100K? More Like $100K Problems. Alright, alright, alright. So BTIG, who are these guys any...