DeFi Tokens 2025: Who's Getting Rich (Again)? - Thoughts?

Solana Meme Coins: Are You Kidding Me?

Okay, lemme get this straight. We're still talking about meme coins in late 2025? After the crash? After all the rug pulls and pump-and-dumps? Seriously? I thought we'd all learned our lesson, but apparently, some people out there are still lining up to gamble their rent money on digital dog pictures.

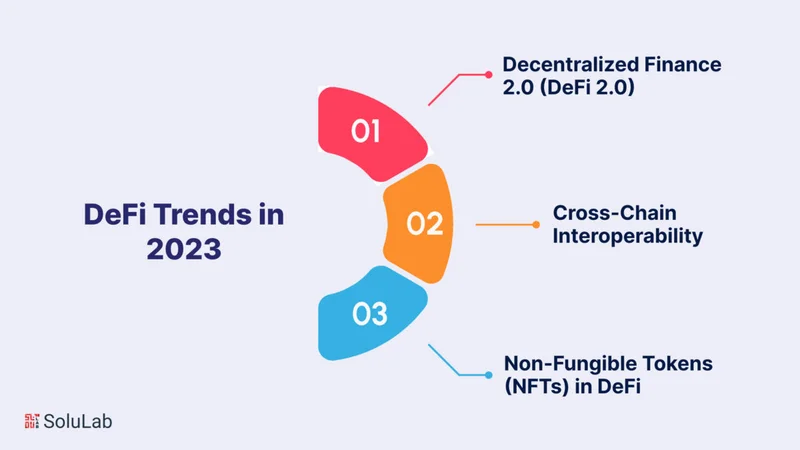

The Illusion of Safety in DeFi

FalconX says investors are looking for "safer names with buybacks" in DeFi. Safer names? In DeFi? That's like saying you're looking for a "slightly less radioactive" nuclear waste dump. And the fact that buybacks are considered a sign of stability just shows how warped things have become. So, the idea is to prop up the price of a useless token by… buying it with more money? How does that create actual value? It's financial alchemy, and anyone who thinks it's a sustainable strategy is deluding themselves. DeFi Token Performance & Investor Trends Post-October Crash

Solana: The King of Crap Coins?

Solana, Solana... It's always Solana. Boasting "1,000+ transactions per second" – whoop-dee-doo. What's the point of all that speed when 99% of those transactions are just people trading glorified Beanie Babies? Sure, they've got "DeFi, NFTs, dApps, and staking platforms". Sounds impressive, right? But let's be real: it's mostly just a playground for degens and grifters.

The Pointless Speed of Solana

And this "Proof of History" and "Proof of Stake" mumbo jumbo? It's designed to "confirm transactions in less than 400 milliseconds." I'm sorry, but does anyone actually need their cat-themed coin transaction to happen in under half a second? Are we all that impatient? This sounds like tech bros solving a problem that doesn't exist.

Decentralization? Think Again.

Validator concentration is another thing. They say that these "high throughput comes with elevated hardware requirements". Translation: only rich people can afford to run this thing, so much for decentralization, huh?

"Community": The New Bagholders?

Oh, and don't even get me started on the "community". These "communities" are just echo chambers of hopium addicts, desperately trying to shill their bags to anyone who'll listen. They use phrases like "strong community backing" and "viral branding." Translation: a bunch of anonymous accounts spamming emojis on Twitter.

Staking Rewards: The Only Incentive?

They are even giving staking rewards! Is that the only thing that keeps them in the game?

The Absurdity of Meme Coin Names

And the meme coins themselves? "Bitcoin Hyper," "Bonk," "Dogwifhat"… These names sound like rejects from a brainstorming session gone horribly wrong. "Cat in a dogs world"? What is this, a poorly written children's book? We're supposed to take this seriously?

The Allure and the Inevitable Outcome

Look I understand the appeal. The idea of getting rich quick off some dumb internet joke is enticing. And yeah, maybe some people actually do make money off this stuff. But for every winner, there are a thousand losers holding worthless tokens, wondering where it all went wrong.

Exhaustion with the Hype

I'm tired of this… I'm just so tired of the hype, the scams, and the sheer stupidity of it all.

Give Me a Break...

Seriously, if you're still buying Solana meme coins in 2025, I don't know what to tell you. Maybe you enjoy losing money. Maybe you think you're smarter than everyone else. Or maybe, just maybe, you're part of the problem. Either way, don't come crying to me when your Dogwifhat investment goes to zero. You've been warned.

Related Articles

Concordium ($CCD) Lists on Kraken: What the Listing Reveals About Its 'Compliance-First' Strategy

The Quiet Bet on Boring: Deconstructing Concordium's Institutional Play Another day, another token l...

Pudgy Penguins: The Price Hype and What We Actually Know

So, everyone’s losing their minds over whether the Pudgy Penguins crypto token, PENGU, can "defend"...

Zcash Surge: Privacy's Back, Baby?

Zcash's Privacy Push: Is It a Real Revolution, or Just Another Crypto Pump-and-Dump? Alright, let's...

Satoshi Nakamoto: The Founder's Identity vs. The Brand's Latest Play

Julian Vance here, cutting through the noise as usual. There's a new sneaker drop on the horizon tha...

PI: Dabo Swinney's Outrage

When Football and AI Collide: A Numbers Game The world of college football witnessed a stunning upse...

NEAR Protocol's Price Prediction: Will it Rally, or is This Another Pump and Dump?

Alright, let's cut the crap. Another day, another crypto project claiming to be the "future," this t...